who pays sales tax when selling a car privately in illinois

This tax is paid directly to the Illinois Department of Revenue. When an illinois resident purchases a vehicle from an out of state dealer and will title the car in illinois the sale and subsequent tax due is reported on form rut 25 when you bring the vehicle into illinois.

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

The taxes can be different in the case of a vehicle being purchased by a private.

. Use the Illinois Tax Rate Finder to find your tax. Vehicle sales tax for vehicles sold by a dealer Usually 625 but can vary by location. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation. Illinois law forbids the sale or. However you do not pay that tax to the car dealer or individual selling the car.

If you sell a vehicle to a customer who will title it in one of those states then you must charge the customer Illinois sales tax at the foreign states tax rate or at 625 whichever is less. A list of all the states for which you must collect sales tax and the rate you must charge can be found on the Illinois Department of Revenues website at. Illinois car payment calculator with amortization to give a monthly breakdown of the principal and interest that you will be paying each month.

Steps To Take When Selling A Car In Illinois - Cash Cars Buyer. If youre in the market for a new car and will be trading in your old one a new law eliminates a 10000 tax credit cap that was set in 2020 as part of the Rebuild Illinois capital plan. Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer.

You will pay it to your states DMV when you register the vehicle. You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. If a vehicle is purchased privately the sales tax must be paid at a branch when you apply for the Indiana certificate of title.

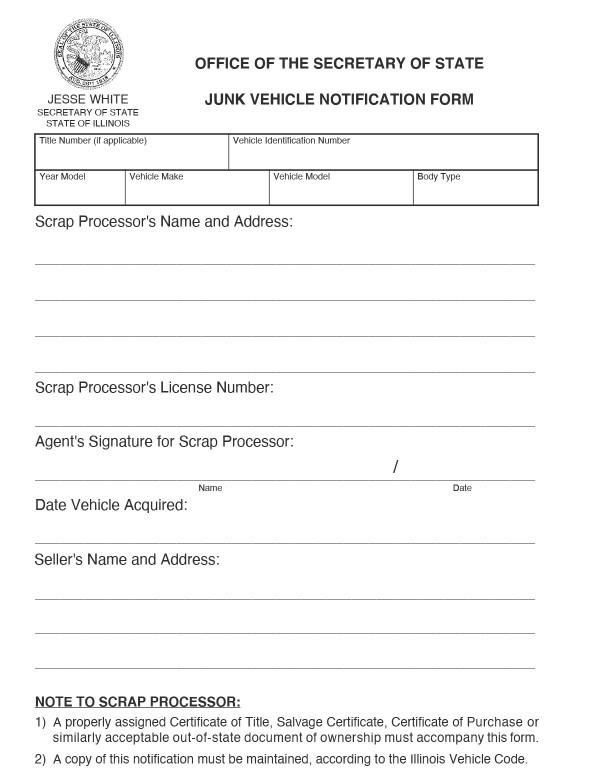

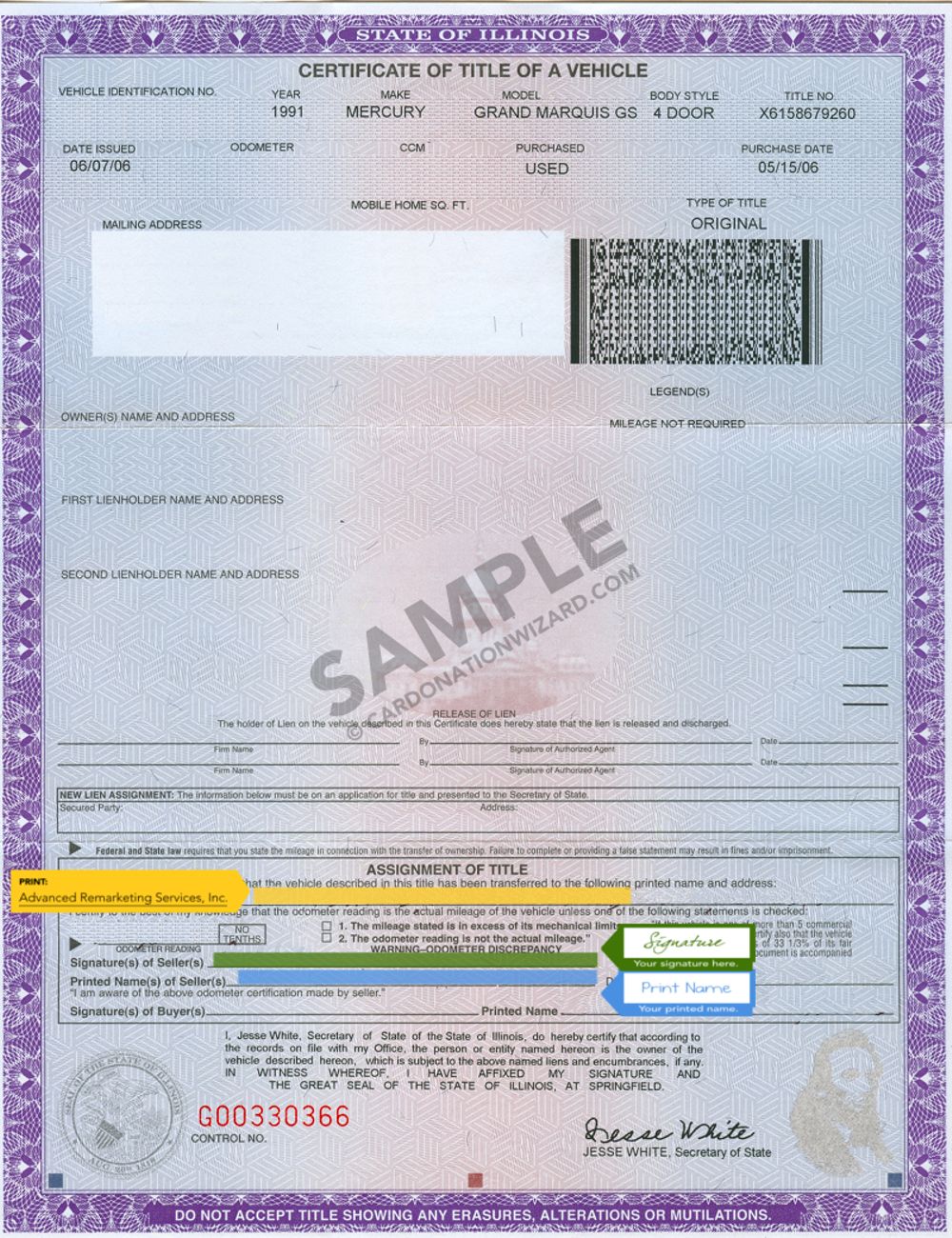

Income Tax Liability When Selling Your Used Car. Illinois law requires the recipient or buyer of any car transferred in the state to complete a Private Party Vehicle Tax Transaction form form RUT-50 and pay sales tax for the car within 30 days of the transfer. Who pays sales tax when selling a car privately in illinois.

As the owner of the vehicle the lessor generally is liable for Illinois Use Tax and responsible for filing and paying this tax using Form RUT-25-LSE when the vehicle is brought into Illinois. DMV or State Fees. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle.

However you the lessee may be required to assume this responsibility. If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid State Form 48842. Clair county illinois sales tax is 735 consisting of 625 illinois state sales tax and 110 st.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. Used cars have had at least one other owner meaning they have history. It ends with 25 for vehicles at least 11 years old.

You typically have to pay taxes on a car received as a gift in illinois. So you get a credit for the Missouri sales tax you pay on your vehicle purchase. There is also between a 025 and 075 when it comes to county tax.

Do not let a buyer tell you that you are supposed to. For vehicles worth less than 15000 the tax is based on the age of the vehicle. The taxes can be different in the case of a vehicle being purchased by a private party.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Saying a sale is a gift is fraud.

The buyer will have to pay the sales tax when they get the car registered under their name. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Transferring License Plates after a Sale.

The general Use Tax Act gives you credit for any sales tax youve already paid out-of-state. To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person. When you sell your car you must declare the actual selling purchase price.

Who pays sales tax when selling a car privately in illinois. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets. Vehicle use tax for vehicles purchased from another individual or private.

However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000. This means you do not have to report it on your tax return. It starts at 390 for a one-year old vehicle.

If you sell it for less than the original purchase price its considered a capital loss. However if you sell it for a profit higher than the original purchase price or what is. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference.

Cost of Buying a Car in Illinois Increased in 2020. Who Pays Sales Tax When Selling a Car Privately in Illinois 19 april 2022 MogulSkier2016 As a result of this decision the Ministry of Finance adopted the position that all incentives to factories are subject to VAT. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000.

In addition to state and county tax the City of Chicago has a 125 sales tax. Thats 2025 per 1000. There also may be a documentary fee of 166 dollars at some dealerships.

Car Tax By State Usa Manual Car Sales Tax Calculator

Free Illinois Bill Of Sale Forms Pdf

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

What S The Car Sales Tax In Each State Find The Best Car Price

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Free Vehicle Private Sale Receipt Template Word Pdf Eforms

Illinois Bill Of Sale Forms And Registration Requirements

Free Vehicle Bill Of Sale Form For A Car Pdf Word

What Paperwork Do I Need To Sell My Car In Illinois Sell My Car In Chicago

Free Illinois Vehicle Bill Of Sale Form Pdf Word

Illinois Used Car Taxes And Fees

Free Vehicle Private Sale Receipt Template Word Pdf Eforms

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

What Is Illinois Car Sales Tax

Illinois Sales Tax Credit Cap Important Information

How Do I Sell My Car Illinois Legal Aid Online

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

Steps To Take When Selling A Car In Illinois Cash Cars Buyer